Unlimited medical benefits should you get sick or have an accident including 24-hour emergency medical assistance, ambulance fees and medical evacuations.

Cover for luggage and personal effects stolen, lost or damaged during travel.

Add cover for rental vehicle excess to make sure you don’t get a nasty surprise if you have an accident on the American roads.

Covers cancellation fees and lost deposits for pre-paid travel arrangements due to unforeseen circumstances.

Cover for the replacement cost of your travel documents including passports, travel documents or travellers cheques lost or stolen from you during your Journey.

Cover for the following items stolen from your person; banknotes, cash, currency notes, postal orders and money orders.

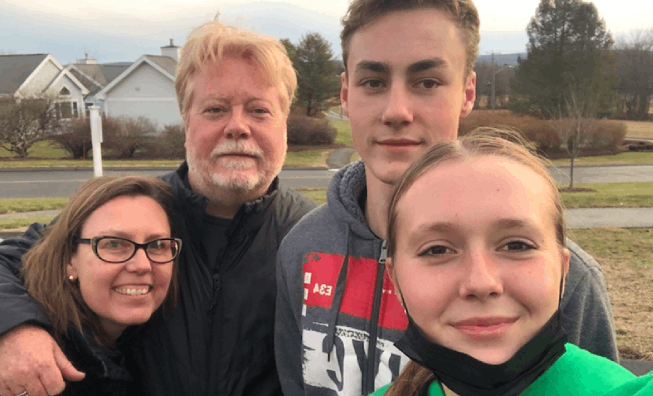

Hundreds of Kiwi's injure themselves each year on the slopes. 52 year old mum, Holly Bisnette knows this all too well after a ski accident in the USA.

Thankfully, the Bisnette’s 1Cover Travel Insurance policy, including snow sports, covered Holly’s significant medical expenses which amounted to AUD$100,000 along with their additional flight costs of AUD$24,000.

Holly’s story, is a warning, and a reminder to pack travel insurance when hitting the slopes.

Please refer to the Policy Wording and policy schedule and check if your sickness or injury is a claimable event and is covered. If you are hospitalised, or if you are treated as an outpatient, or if the total cost of the treatment will exceed $1000, please contact our emergency assistance service as soon as possible to obtain their prior approval.

In circumstances where the claim is approved, we can then provide written guarantees of payment of reasonable expenses for emergency hospitalisation that may be required while you are in the USA.

Yes, of course. If you want to extend your policy while you’re in the USA, the easiest way to do this is via the Policy Manager.

You'll need your policy number (available in the email confirming your policy), and a few other simple details. Log-in and extend your trip, add destinations, or buy add ons/extras.

Make sure you extend your policy before it expires.

If you have trouble, you can email us at [email protected]

Please note there may be instances where a policy extension is not available.

If you are robbed while you’re on holiday, you should report the theft to the police or nearest local authority immediately. You will also need to obtain a written report to be used as supporting documents for your claim.

If you are entitled to be reimbursed by the bus line, airline, shipping line or rail authority you were travelling on when the loss, theft, misplacement or damage occurred, then your travel insurance may not cover you.

However, if you are not reimbursed the full amount of your claim, we will assess your claim and you may be entitled to be paid the difference between the amount of your loss and what you were reimbursed, up to the limit of your cover (allowing for depreciation due to age, wear and tear).

Our Comprehensive, Overseas Frequent Traveller, and Already Overseas policies, rental vehicle insurance excess cover is not included automatically. Under these policies, you can add cover for rental vehicle insurance excess up to $10,000 by paying an additional premium.

You may choose your own medical advisor, or we can appoint an approved medical advisor to see you.

Please note: if you do not get the medical treatment you expect, although we can assist you, 1Cover are not liable for anything that results from that treatment. If you are unwell overseas please contact us.

If you're only stopping over in the US, you need to include it in the destinations you are travelling to in order to be covered. We will cover you for stopovers of up to two nights in the US as long as you nominate the United States as a destination when you apply for cover.

When you apply for a policy you need to tell us where you are travelling to. The premium you pay for the policy depends on your destination(s).

The policy only covers loss, injury or illness which occurs in the countries you have told us you will visit. We will cover you for stopovers of up to two nights in the USA but you must nominate USA as a destination when you apply for cover.

If you’re going on a cruise, you must select the appropriate region. For cruises in the USA, the appropriate region you will need to select is Worldwide Cruise. You MUST pay an additional premium for travel on a cruise vessel by purchasing the Cruise Pack. If you do not, you will not be covered while on the ship. There is, however, no cover under any sections of the policy when you are on a cargo ship or freighter.

We have a policy called Frequent Traveller which allows you to take as many trips under the one policy for 12 months and enjoy comprehensive cover on each one. There is a limit to the maximum length of each trip on these policies. You can travel to one or more destinations with this policy.

Find out more about our annual travel insurance policies here.

Laptop computers, cameras, mobile phones…they’re all things we need on at home and on holiday. That’s why you can choose a bit of extra protection for your can’t-live-withouts. All you need to do is include and specify certain high-value items that aren't automatically covered when you're buying your policy.

Note: the items cannot be older than 12 month, and you can't specify items like jewellery, watches, bicycles and watercraft (apart from surfboards).

Travel insurance provides cover for weather events as long as they are unforeseen. Our policies do not cover claims for losses caused by an event that you were aware of at the time of purchasing your policy.

Once an event has become published in the mass media, it is expected that you have purchased your insurance with this knowledge in mind. 1Cover will, where possible, issue travel warnings in relation to such large scale events and the dates and times after which they are not seen as an unforseen event.

Overseas Emergency Medical Assistance: Includes 24-hour emergency medical assistance, ambulance fees, medical evacuations, funeral arrangements, and messages to family and hospital guarantees.

Overseas Emergency Medical And Hospital Expenses: Cover if you are injured or become sick overseas, including; medical, hospital, surgical and nursing.

Dental Expenses: Cover for your emergency dental treatment for the relief of sudden and acute pain to sound and natural teeth.

Additional Accommodation & Travel Expenses: Cover for additional travel expenses if you cannot travel because of an injury or sickness (whilst overseas).

Family Emergency: Cover for additional travel expenses if your travelling companion, or a Relative of either of yours, dies unexpectedly, is disabled by an injury or requires hospitalisation.

Emergency Companion Cover: Cover for additional travel and accommodation expenses if your travelling companion cannot continue their Journey because of an injury or sickness.

Resumption Of Journey: Cover for the cost of airfares for you to resume your journey if you return home because of the unexpected death or hospitalisation of a relative of yours.

Hospital Cash Allowance: Hospital Cash Allowance

Permanent Disability: A permanent disability benefit is payable for total loss of sight in one or both eyes or loss of use of a hand or foot (for at least 12 months, and which will continue indefinitely) within 12 months of, and because of, an injury sustained during your journey.

Loss Of Income: A weekly loss of income benefit is payable if you become disabled within 30 days of an injury you sustained during your journey, and you are still unable to work more than 30 days after returning to New Zealand.

Credit Card Fraud & Replacement: Cover for the replacement cost of your credit cards lost or stolen from you during your journey, and loss resulting from fraudulent use.

Travel Documents & Traveller's Cheques: Cover for the replacement cost of your travel documents including passports, travel documents or travellers cheques lost or stolen from you during your Journey.

Theft Of Cash: Cover for the following items stolen from your person; banknotes, cash, currency notes, postal orders and money orders.

Luggage & Personal Effects: Cover for luggage and personal effects stolen, lost or damaged during travel. Common claims include luggage, personal effects, cameras, spectacles and a computer.

Luggage & Personal Effects Delay Expenses: Cover to purchase essential items of clothing and other personal items following Luggage delayed and Personal Effects being delayed, misdirected or misplaced by your carrier for more than 12 hours.

Cancellation Fees And Lost Deposits: Covers cancellation fees and lost deposits for pre-paid travel arrangements due to unforeseen circumstances neither expected nor intended by you, and which are outside your control, such as; sickness, injuries, strikes, collisions, retrenchment and natural disasters.

Disruption Of Journey: Cover for additional meals and accommodation expenses, after an initial 6 hours delay, if your Journey is disrupted due to circumstances beyond your control.

Alternative Transport Expenses: Cover for additional travel expenses following transport delays to reach events such as; a wedding, funeral, conference, sporting event and pre-paid travel/tour arrangements.

Personal Liability: Cover for legal liability including legal expenses for bodily injuries or damage to property of other persons as a result of a claim made against you.

Rental Vehicle Excess: Cover for the excess payable on your rental vehicle's motor vehicle insurance resulting from the rental vehicle being; Stolen, crashed or damaged and/or cost of returning the rental vehicle due to you being unfit to do so.

Wherever you’re going in the USA, our USA Survival Guide is packed with all the top tips and must-know advice to stay safe on your adventure.

It’s one of the world’s most famous sites and draws close to one million visitors every year. But here's why it might not be worth your time.

And it's not Disneyland. This historic family fun park has a long list of attractions for young and old, as well as being a fantasy for anyone with a sweet tooth.

Escape the cities and discover the diverse landscape of the USA. You've got Yellowstone, Zion, or the Grand Canyon to name a few.

LA, Colorado, or Montana, there is no many one-derful ski reports to try out in the UA of A

The Pacific coast highway, the Blue ridge parkway, you are spoilt for choice with the incredible roads to explore in America.

“1Cover have always dealt with my claims in a professional manner. We have no hesitation in recommending 1Cover.”

“We will always use 1Cover now - outstanding service, great experience (apart from the torn ACL). Huge thanks service was outstanding!”

In our 72 years, we have never had a travel claim. Thank you for making a horrendous time truly easy!

We hope nothing goes wrong on your trip to USA. But if it does, the resources in this section can help you.

New Zealand has an Embassy and several consulates throughout the USA. They provide a range of services to the general public, including consular, passport, visa and immigration, citizenship and cultural relations services.

Be informed. Be prepared. If you're across The New Zealand Government's SafeTravel website, you'll have all the latest information for your trip to the USA. SafeTravel is a trusted resource for New Zealander travellers and is updated regularly, so make sure you bookmark this handy resource.

If you need emergency assistance in the USA, please call our 24/7 emergency medical assistance line on email [email protected].

For non-emergency assistance, you can message our Sydney-based support centre seven days a week.

If something happens to you and it's not an emergency, you can start the claims process whenever it's convenient to you. Visit our online claims platform, and if you have all the necessary documentation, your claim will be processed in 10 business days.

If you have any other questions or queries, please send us a message via our Contact Us page.

If you are experiencing an emergency, please use the details on our Emergency Assistance page.