Who is the best travel insurance company? We show you what to look for to compare travel insurance policies so you can make the right choice.

You want to compare travel insurance but it can seem daunting. You may be asking what is the best travel insurance? Is it worth it to get Travel Insurance? What is covered by Travel Insurance?

In this guide, we show you what to look for when comparing travel insurance policies. We've included what is covered, what isn’t, terms and conditions to look out for, and a whole heap of useful information to help you make the right choice.

If you want to compare credit card travel insurance, we’ve created a comprehensive guide on a separate page.

If you can’t afford travel insurance, then you can’t afford to travel. Comparing different policies will help you save money for the more important things, like enjoying your trip!

Peace of mind when you’re travelling is so important. We show you what to look for when buying a policy so you know exactly what you’re covered for, without having to dig through pages of terms and conditions.

At 1Cover, we’ve been in the travel insurance industry for over 15 years. We’ve been trusted by over 1.5 million travellers worldwide to look after them on their trips both domestic and abroad. If there’s one thing we know, its travel insurance.

Travel insurance is meant to protect you from unexpected losses that are incurred when you’re travelling. When comparing travel insurance policies it is important to make sure you know exactly what you’re covered for. Many people don't ask themselves the right questions or find out if they're covered for things like adventure sports, skiing, or cruising before they head off.

When comparing policies and trying to find the best travel insurance for you, remember to read the product disclosure statement (PDS) in full.

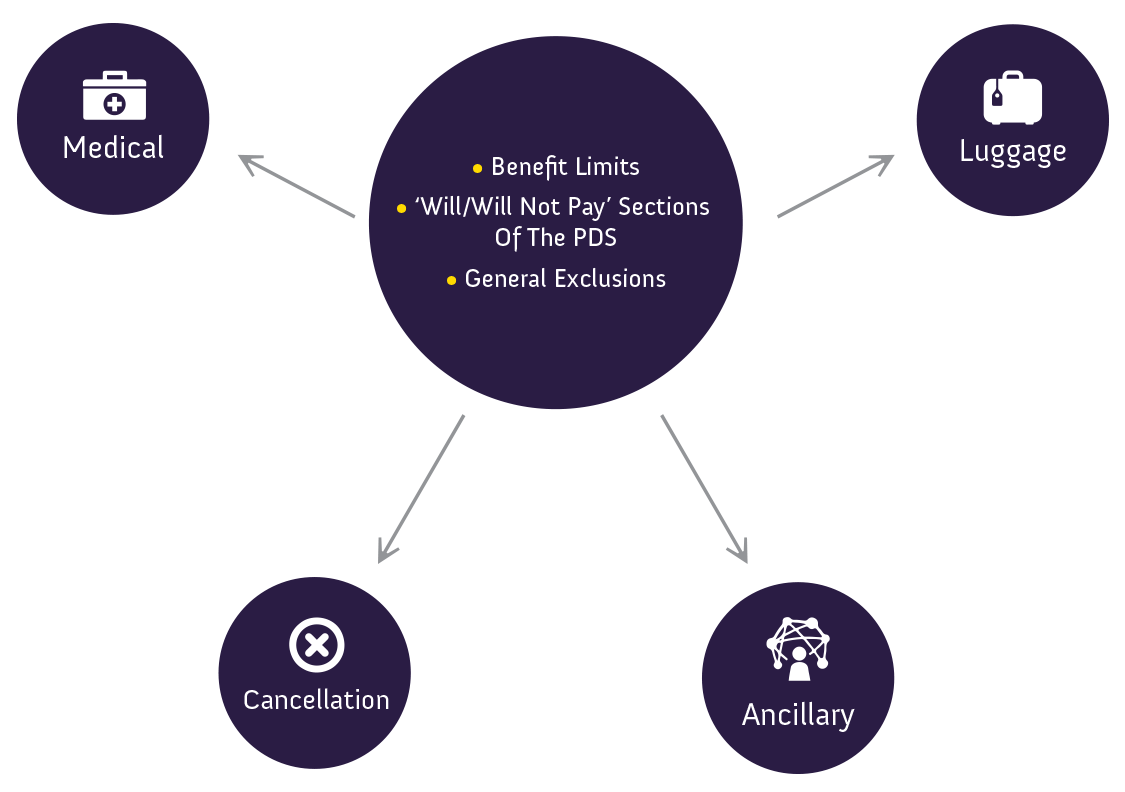

A comprehensive policy should provide cover for at least the following. Be sure to check the benefit limits in relation to each component of coverage as these can change drastically between providers.

Medical

Medical

The most important aspect of your cover, after all, you can’t put a price on your health. Read more about what 1Cover can do for your medical coverage.

This will be a key consideration for any long-term trips you may have planned. Be sure to read the terms and conditions of your policy before paying any deposits for flights, accommodation or with your travel agent.

This should include not only luggage and personal effects but delay expenses and theft of cash.

Should include personal liability as a minimum.

Travel insurance policies are designed to cover you for unforeseen circumstances that could occur when you’re travelling. Most if not all travel insurance policies will not cover the following instances, so keep these in mind next time you are comparing policies.

Not just New Zealand laws, but be aware of local laws as well.

Always check SafeTravel for the latest travel advice

Insurers won’t cover you if you have to cancel your trip because of a natural disaster if you purchased your policy after the event was made public in the mass media.Do your research before you plan your next trip!

Leaving your things lying around is asking for someone to take them.

Travel Supplier Financial Default

Travel Supplier Financial Default

Be sure to use a reputable travel provider, as most insurers won't provide cover for financial collapse.

This can be a grey area, but this is a general exclusion in most if not all travel insurance policies.

Ignorance is not always bliss. Just because you thought something was covered, doesn’t mean it will be. Always read the Policy Wording.

Have you got an action packed trip planned? Are you going skiing or taking part in winter sports? Generally, insurers take three different approaches to providing cover for activities:

Automatically included in your policy

Can be included at an increased premium

Excluded from cover

* Exclusions apply see PDS for full details.

When comparing travel insurance, where your cover comes from can tell you a lot about the customer service, quality of cover and care you are likely to receive.

Travel insurance is the primary focus of these businesses, meaning they are specialist and experienced in the industry. They are also often the cheapest as they don’t have to pay commissions. 1Cover provides travel insurance direct to customers and we do not pay expensive travel agent commission so we keep insurance premiums lower

These brands are backed by large, well-known organisations. But travel insurance is rarely their primary focus, so they might not have the same level of expertise as Travel Insurance specialists like 1Cover.

Credit card travel insurance can be included in your card fees, however be sure to check the levels of cover and benefit limits of your insurance, as these can be much lower than from other providers.

Insurance provided by your travel agent may be very similar to what direct insurers provide. It is always important to know that the travel agent is acting as a middleman for another insurer meaning you might be paying much higher premiums. Ask them what commission they get for selling Travel Insurance, and then always compare their quotes. It only takes 30 seconds to get a 1Cover quote.

On the surface, all travel insurance providers can seem the same, but if you’re going to trust them with your safety and peace of mind on your next trip, it’s important to dig a little deeper. When comparing between different providers, ask yourself the following:

Do they have a 24-hour emergency assistance service?

Are they underwritten by a company you know and trust?

Do they have positive online customer reviews?

Do they manage their own claims?

Do they specialise in travel insurance?

Just pick the cheapest one, right? Well, sort of. There are a few other things you should keep in mind when comparing travel insurance policies based on price.

As a general rule of thumb, the more risky your travel plans are, the higher the cost of your insurance will be. The cost of your travel insurance is determined by a number of variables;

The distance your destination is from New Zealand, and the cost of medical care there will affect the price of your insurance.

Dates

Dates

The longer the duration of your trip, the more you insurance will cost.

Age

Age

Sorry, there’s not much you can do about this.

Pre-Existing Medical Conditions

Pre-Existing Medical Conditions

Most policies will have a list of automatically included conditions. Applying for cover outside of these may increase the cost of your policy.

Extras

Extras

Adding extras such as high-value items, ski rental excess cover or heli-skiing cover will increase the price of your policy.

Insurers have different ways of assessing the cost of covering your pre-existing condition. Be sure to raise this issue with your chosen provider when purchasing a policy.

If you don't meet the neccesary criteria, you can still get travel insurance. It might just mean that:

You can obtain travel insurance, but if you want your medical condition to be covered, you'll need to pay; or

you can obtain travel insurance but it will be mandatory to purchase coverage for your medical condition; or

your medical condition won't be covered at all, but you can still purchase travel insurance.

Please note, there's a possibility we might not be able to cover you at all, but we will tell you this during your medical assessment.

While comparing price is simple enough, comparing cover can be a little more complicated. Always remember that not all travel insurance policies are the same, and comprehensive does not necessarily mean ‘absolutely everything’ is covered.

The key things you should look out for when comparing policies are:

The benefit limits below apply to medical claims for 1Cover comprehensive policies. These can be used as a benchmark when comparing the medical benefit limits of other policies.

| Policy Benefits | Comprehensive | Medical Only | |

|---|---|---|---|

Emergency | |||

| 24/7 Emergency Assistance Service | included | included | |

Medical | |||

| Overseas Emergency Medical & Hospital Expenses | SO | unlimited | unlimited |

| Dental Expenses | O | $2,000 | $2,000 |

| Hospital Cash Allowance | SO | $5,000 | - |

| Repatriation Of Remains | O | $25,000 | $25,000 |

| Permanent Disability | O | $25,000 | - |

| Loss of Income | SO | $10,400 | - |

Benefits shown are a summary of cover only. Sub-limits may apply. Please read the Policy Wording for full terms, conditions, limits, excess payable and exclusions to determine whether our travel insurance is right for you. A Limits are per adult traveller. For accompanying dependants, the policy benefits are shared with the adult traveller. S Sub-limits apply. P Limits are per policy regardless of the number of persons the claim relates to. O There is no cover while travelling in New Zealand. |

|||

The medical benefit limits for 1Cover policies refer to the following situations:

Includes 24-hour emergency medical assistance, ambulance fees, medical evacuations, funeral arrangements, and messages to family and hospital guarantees.

Cover if you are injured or become sick overseas, including; medical, hospital, surgical and nursing.

Cover for your emergency dental treatment for the relief of sudden and acute pain to sound and natural teeth.

Cover for additional travel expenses if you cannot travel because of an injury or sickness (whilst overseas).

Cover for additional travel expenses if your travelling companion, or a relative of either of you is aged 84 or under and resides in Australia or New Zealand, dies unexpectedly, is disabled by an injury or requires hospitalisation.

Cover for additional travel and accommodation expenses to remain with your travelling companion if he or she can't continue their journey because of an injury or sickness.

An allowance of $50 per day if you are hospitalised for more than 48 continuous hours while overseas.

Funeral costs overseas, and/or repatriation costs of your remains to your home are covered.

A permanent disability benefit is payable for total loss of sight in one or both eyes or loss of use of a hand or foot (for at least 12 months, and which will continue indefinitely) within 12 months of, and because of, an injury sustained during your journey.

A weekly loss of income benefit is payable if you become disabled within 30 days of an injury you sustained during your journey, and you are still unable to work more than 30 days after returning to Australia.

The following benefit limits apply to luggage claims for 1Cover comprehensive policies. These can be used as a benchmark when comparing the benefit limits of other policies.

| Policy Benefits | Comprehensive | Medical Only | |

|---|---|---|---|

Luggage & Personal Items | |||

| Travel Documents & Transaction Cards | O | $5,000 | - |

| Theft of Cash | PO | $250 | - |

| Luggage & Personal Effects | AS | $15,000 | - |

| Luggage & Personal Effects Delay Expenses | ASO | $15,000 | - |

Cancellation & Delay | |||

| Pre-Departure Cancellation Fees & Lost Deposits | PS | chosen limit | - |

| Pre-Departure Amendments to Journey | A | $2,000 | - |

Benefits shown are a summary of cover only. Sub-limits may apply. Please read the Policy Wording for full terms, conditions, limits, excess payable and exclusions to determine whether our travel insurance is right for you. A Limits are per adult traveller. For accompanying dependants, the policy benefits are shared with the adult traveller. S Sub-limits apply. P Limits are per policy regardless of the number of persons the claim relates to. O There is no cover while travelling in New Zealand. |

|||

The luggage benefits for 1Cover policies refer to the following situations:

Cover for the replacement cost of your credit cards lost or stolen from you during your journey, and loss resulting from fraudulent use.

Cover to purchase essential items of clothing and other personal items following Luggage delayed and Personal Effects being delayed, misdirected or misplaced by your carrier for more than 12 hours.

The following benefit limits apply to cancellation and on-trip disruption claims for 1Cover comprehensive policies. These can be used as a benchmark when comparing the benefit limits of other policies.

| Policy Benefits | Comprehensive | Medical Only | |

|---|---|---|---|

Cancellation & Delay | |||

| Pre-Departure Cancellation Fees & Lost Deposits | PS | chosen limit | - |

| Pre-Departure Amendments to Journey | A | $2,000 | - |

On-trip Disruption | |||

| On-trip Cancellation Fees & Lost Deposits | PS | chosen limit | - |

| Additional Accommodation & Travel Expenses — Family Emergency — Emergency Companion Cover | AS | $50,000 | - |

| Travel Delay Expenses | S | $2,000 | - |

| Special Event Transport Expenses | O | $2,000 | - |

Benefits shown are a summary of cover only. Sub-limits may apply. Please read the Policy Wording for full terms, conditions, limits, excess payable and exclusions to determine whether our travel insurance is right for you. A Limits are per adult traveller. For accompanying dependants, the policy benefits are shared with the adult traveller. S Sub-limits apply. P Limits are per policy regardless of the number of persons the claim relates to. O There is no cover while travelling in New Zealand. |

|||

Cancellation benefits for 1Cover policies refer to the following situations:

Cover for cancellation fees and lost deposits for pre-paid travel arrangements due to unforeseen circumstances neither expected nor intended by you, and which are outside your control, such as; sickness, injuries, strikes, collisions, retrenchment and natural disasters.

Cover for additional travel expenses following transport delays to reach events such as; a wedding, funeral, conference, sporting event and pre-paid travel/tour arrangements.

The following benefit limits apply to ancillary claims for 1Cover comprehensive policies. These can be used as a benchmark when comparing the benefit limits of other policies.

| Policy Benefits | Comprehensive | Medical Only | |

|---|---|---|---|

Other | |||

| Personal Liability | P | $5 million | $5 million |

| Domestic Pets | S | $500 | - |

| Domestic Services | SO | $500 | - |

Benefits shown are a summary of cover only. Sub-limits may apply. Please read the Policy Wording for full terms, conditions, limits, excess payable and exclusions to determine whether our travel insurance is right for you. A Limits are per adult traveller. For accompanying dependants, the policy benefits are shared with the adult traveller. S Sub-limits apply. P Limits are per policy regardless of the number of persons the claim relates to. O There is no cover while travelling in New Zealand. |

|||

Ancillary benefits for 1Cover policies refer to the following situations:

Cover for legal liability including legal expenses for bodily injuries or damage to property of other persons as a result of a claim made against you.

Cover for additional boarding kennel or cattery fees resulting from your delayed return home, also veterinary fees if your pet is injured while you are away.

Cover for housekeeping services following injury/disablement continuing upon your return home.

Cover for the excess payable on your rental vehicle's motor vehicle insurance resulting from the rental vehicle being; Stolen, Crashed or Damaged and/or cost of returning the rental vehicle due to you being unfit to do so.

When comparing travel insurance providers, the proof is in the pudding. When you go to make a claim you want to know that you’re going to be looked after properly. But how will you know before purchasing a policy? Use the checklist below to find out more about how your chosen provider assesses claims.

Customer Reviews

Customer Reviews

Check online to find customer reviews about your provider, paying attention to reviews that have verified claims.

In House Claims Department

In House Claims Department

Does your provider manage their own claims or outsource this to another business?

Claims Turnaround

Claims Turnaround

How long does it take your provider to pay claims? You can usually find this in the product disclosure statement.

General Exclusions

General Exclusions

Pay special attention to the general exclusions in the Policy Wording.

Underwriter You Know And Trust

Underwriter You Know And Trust

Make sure your travel insurance provider is underwritten by a reputable underwriter.

If you have any other questions or queries, please send us a message via our Contact Us page.

If you are experiencing an emergency, please use the details on our Emergency Assistance page.